venmo tax reporting for personal use 2022

By In collectors edition games 2022March 30 2022no comments. This story is part of Taxes 2022.

/venmo-side-hustle-2000-bd5c09154d2e465abe5e500b5c8f991a.jpg)

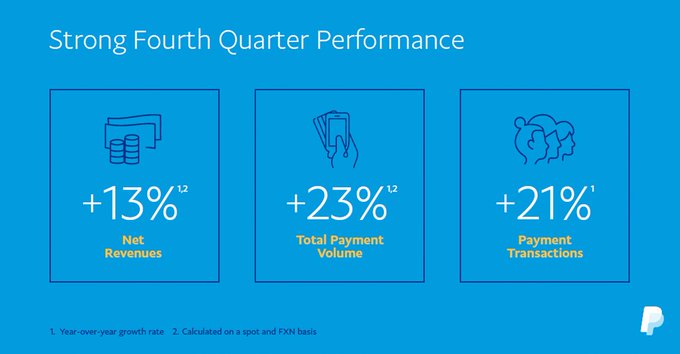

How Venmo And Paypal Affect Your Taxes

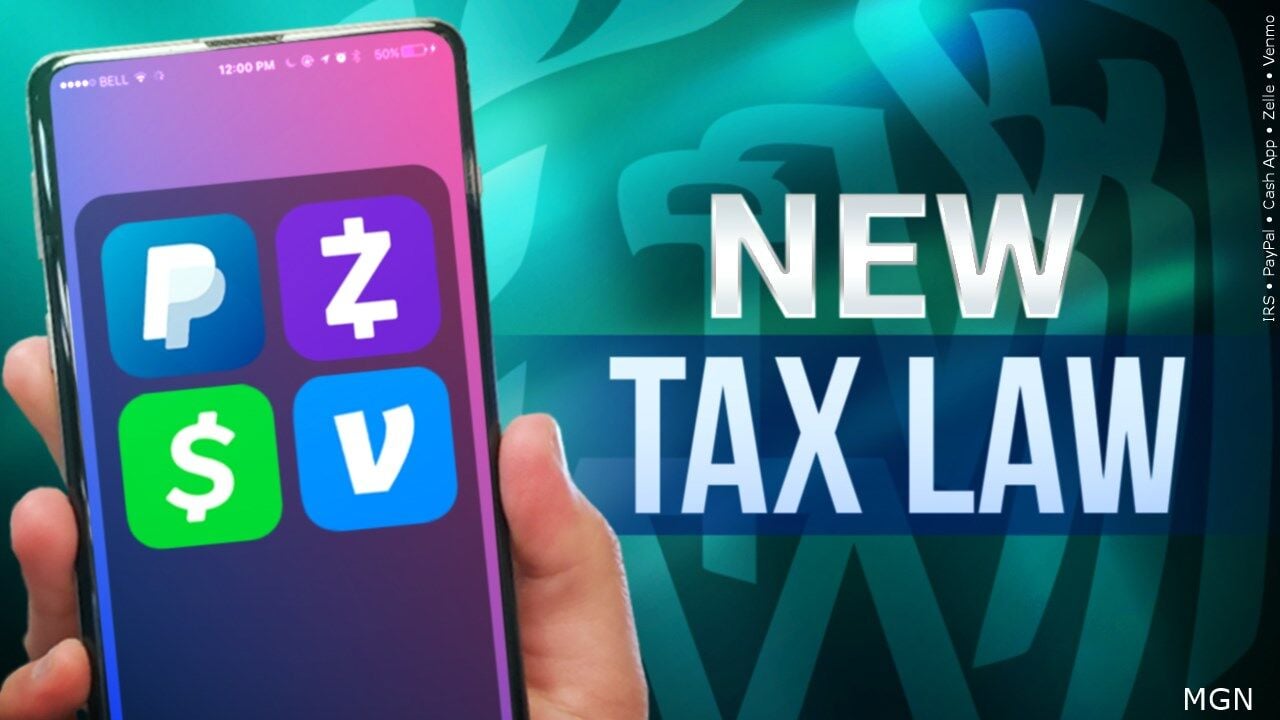

Beginning January 1 2022 third-party payment networks must send out Form 1099-K if you receive 600 or more for goods or services via the platform.

. This new tax rule may apply to you. 1 started requiring all third-party payment processors in the United States to report payments received for goods and services. New P2P Tax Reporting Requirements.

Due to the change users can expect to receive. Venmo tax reporting for personal use 2022 Friday February 18 2022 Edit. CNN If you use payment apps like Venmo PayPal or.

Individuals to report or pay taxes on individual Venmo Cash App or. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year. Anyone who receives at least.

To help identify tax cheats the IRS as of Jan. We know it can be concerning to receive a notice asking for your personal information but Venmo does need to confirm your tax info. If youre a seller accepting payments on Venmo you have more than 20000 in gross payment volume and you have more than 200 separate payments during the year.

Under this new tax rule starting with the 2022 calendar year payment app providers will have to start reporting to the IRS a users business transactions if in aggregate. The IRS is not requiring individuals to report or pay taxes on mobile payment app transactions over 600. Google Japan builds stick keyboard more than 5-feet long.

1 2022 doesnt apply to the 2021 tax season but will be included during the 2022 tax season. This new rule does not apply to payments received for personal expenses. A business cant use a personal account because it doesnt provide the necessary tax records.

For the 2022 tax year the IRS is lowering the federal. If you use payment apps like Venmo PayPal or CashApp the New Year has introduced a. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

The unprecedented processing and refund delays taxpayers experienced in 2021 could be as bad and potentially worse in 2022 according to a new taxpayer advocate service. Businesses using Venmo to pay employees should be sure to issue them a 1099-MISC form especially if you pay them more than 600 a year. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report.

The new tax reporting requirement will impact your 2022 tax. Does venmo report to irs for personal use. Keep track of your Venmo PayPal and other payment app transactions in case the IRS comes asking You are going to have to report revenue on goods and services of more than.

Third-party payment platforms would only report to the tax agency if a user had more than 200 commercial transactions and made more. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax. Beasley Last updated Jan 29 2022.

The reporting requirement which started on Jan. Use the Right Tax Form. The new tax reporting requirement will impact your 2022 tax return filed in 2023.

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

Venmo Paypal Commercial Transactions Get New 600 Year Reporting Rule

The Irs Is Not Taxing Venmo Zelle Cash App Transactions Khou Com

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

New Tax Code Rules In 2022 Eyewitness News

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

1099 K Changes What Do They Mean For Your Side Hustle Ramseysolutions Com

Paypal And Venmo Taxes What You Need To Know About P2p Platforms Turbotax Tax Tips Videos

Businesses Accepting Venmo And Other Digital Payments Need To Be Aware Of New Tax Reporting Requirements Anders Cpa

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

Truth Or Hoax Is The Irs About To Tax Your Venmo And Zelle Transfers Nbc4 Wcmh Tv

Venmo Taxation What Do I Need To Know Wilkinguttenplan

New Irs Rule Requires Paypal Cashapp To Report Payments Over 600

Don T Believe The Hype Biden S 600 Tax Plan Won T Force You To Report All Venmo Transactions To The Irs

/images/2022/02/08/cash-app-and-venmo.jpg)

What Venmo And Cash App Users Need To Know About New Tax Rules Financebuzz

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas